reverse sales tax calculator texas

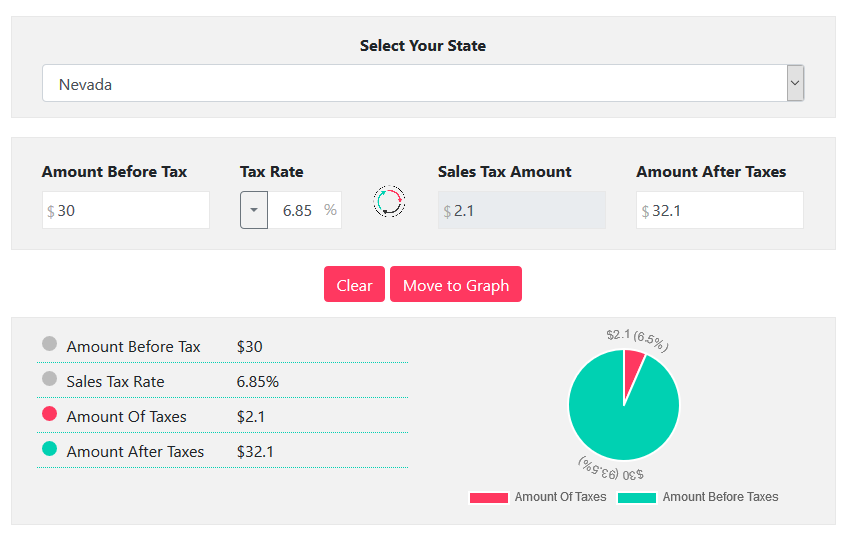

Changing the Additional Sales Tax Rate. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

How To Calculate Sales Tax Backwards From Total

The minimum is 625 in Texas.

. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. In Texas prescription medicine and food seeds are exempt from taxation. Now find the tax value by multiplying tax rate by the before tax price.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. Reverse Sales Tax Calculations. 75100 0075 tax rate as a decimal.

The exciting Log feature gives you a quick and easy way to save lists of items. Firstly divide the tax rate by 100. Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681.

Formula s to Calculate Reverse Sales Tax. Texas Sales Tax Calculator. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. In Texas prescription medicine and food seeds are exempt from taxation. Texas has a 625 statewide sales tax rate but also has 998 local tax jurisdictions including cities towns counties and special districts that.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Sales Tax Rate Sales Tax Percent 100. Like income tax calculating sales tax often isnt as simple as X amount of money Y amount of state tax In Texas for example the state imposes a 625 percent sales tax as of 2018.

Tax 940 0075. However cities counties transit authorities and special tax districts may together increase the tax by up to 2 percent total. Tax 705 tax value rouded to 2 decimals.

If the sales tax rate increased for example from 00025 to 0005 the taxing unit must have two sales tax projections. If the taxing unit either increases or decreases the sales tax rate from last year the taxing unit must perform an additional step to determine the projected sales tax. Please note that special sales tax laws max exist.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. Calculate Car Sales Tax in Texas Example.

To add tax to the price of an item multiply the cost by 1 the sales tax rate as a decimal. Enter the sales tax percentage. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

The Sales Tax Formula used to calculate the final price inclusive of tax before tax price in case of Reverse Sales Tax is provided below. Business entities use reverse sales tax to understand the actual price of a product and the tax attributed to it. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart.

Please check the value of Sales Tax in other sources to ensure that it is the correct value. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tax Me Pro also comes equipped with a fully functional calculator the ability to save lists of items reverse tax calculation and a companion Apple Watch app.

Before-tax price sale tax rate and final or after-tax price. Amount without sales tax QST rate QST amount. Amount without sales tax GST rate GST amount.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. Enter the total amount that you wish to have calculated in order to determine tax on the sale. Various sites provide this service to their users free of.

Calculate Reverse Sales Tax. It is a unique sales tax calculator that is easy to use accurate and attractive. Sales TaxFinal Price Inclusive of Tax Before Tax Price 1 Tax Rate 100.

Multiply the vehicle price after trade-in andor incentives by the sales tax fee. Vermont has a 6 general sales tax but an. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts.

Reverse sales tax calculator texas. To easily divide by 100 just move the decimal point two spaces to the left. Sales Tax 35000 - 3000 - 1000 0625 Sales Tax.

Here is how the total is calculated before sales tax. The first script calculates the sales tax of an item or group of items then displays the tax in raw and rounded forms and the total sales price including tax. And all states differ in their enforcement of sales tax.

PRETAX PRICE POSTTAX PRICE 1 TAX RATE. You obviously may change the default values if you desire. Tax Me Pro is designed with quality and functionality in mind.

A reverse sales tax calculator is a computer-based method to calculate sales tax backward. Price before Tax Total Price with Tax - Sales Tax.

Tip Sales Tax Calculator Salecalc Com

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator Calculator Academy

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How To Find Original Price Tax 1 Youtube

Quebec Tax Calculator Gst Qst Apps On Google Play